Listening to the reaction of some pub owners, you could be left thinking that this 50% increase in the rate will be dreadful for businesses, and cause lots of job losses.

Should people working in restaurants and pubs should be worried about their jobs? Will staff be laid off, or have their hours reduced? Will businesses stop hiring new waiting staff, bar-tenders and chefs in 2019?

No one will know for certain until the year is well under way.

But it looks unlikely.

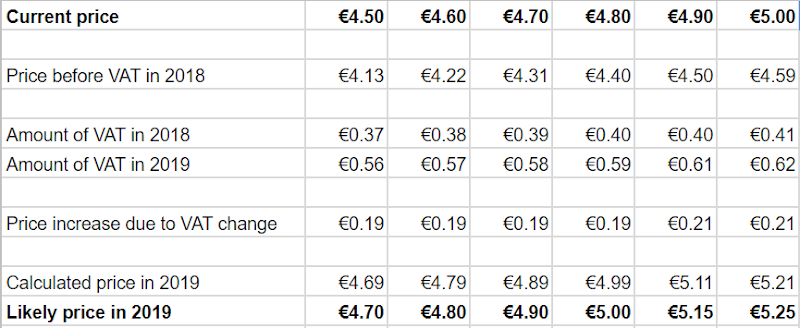

Yes, there will be some price increases, probably between 20 and 25c per pint (see below for an explanation of this). Some customers will be annoyed, and January might be a little drier than usual while they get over this. Price increases in expensive venue will be proportionately higher: a meal that is €100 now will likely increase to €104.50. But probably the effect will be small, and barely notice by most people employed in the hospitality industry.

That said, maybe some jobs which would have been filled in early January will be delayed a little - but this is likely to be due to worries about the effect of Brexit, than a minor change to the VAT rate. Some people will have their hours - but this happens most years in the winter season.

Working out the effect of the VAT increase on the price of a pint

Imagine a pint that costs €5.00 in 2018. (It's easier to work with a nice round figure). Roughly speaking this is made up of:- The cost of the beer (including profit for the brewery and distributor, and brand-marketing),

- The excise tax on it,

- The cost of getting it to the pub where it's served (including profit for the transport company)

- The cost of serving it (including the building rental, heating, lighting, insurance, the staff time, washing the glass it's served in - and profit for the publican).

- If the VAT rate is 9% then €5 is made up of around €0.41 of VAT, and €4.59 of pre-tax-price.

- When the VAT rate is 13.5%, the pre-VAT price is still €4.59, the VAT is €0.61, taking the likely final price to €5.20 or €5.25.